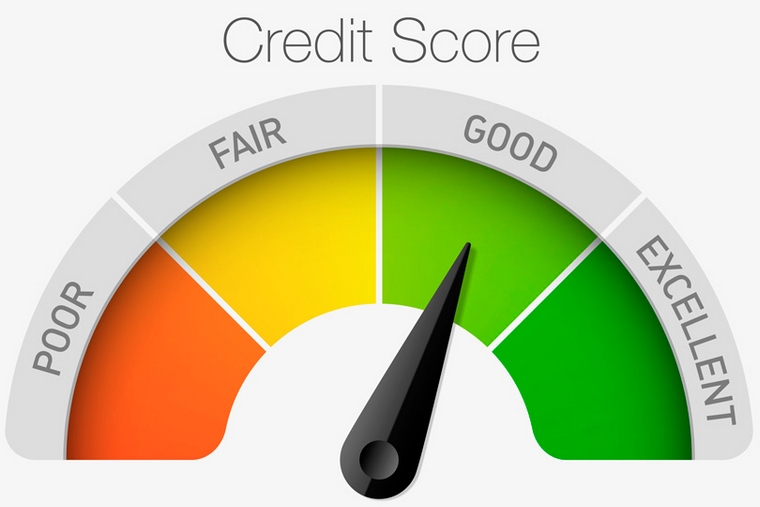

Credit history shapes your CIBIL ratings. A CIBIL score of less than 750 may be a barrier for people who want a personal loan right away. This is, however, just a starting point that may be enhanced. All you have to do now is focus on the parameters listed below to get your loan accepted as quickly as possible. In this article, you will get to know that This is an important point on how to increase CIBIL score.

1. Pay EMIs and credit card bills on time

Making late payments on a current loan is the wrong choice since it might hurt your credit score. When it comes to EMI payments, punctuality is essential. You will not only be fined if you skip an EMI, but your credit score will suffer as well if you have trouble remembering dates and set reminders to pay on time. This is an important point on how to increase CIBIL score.

2. Check your credit report for any mistakes

Even if you believe you have a good credit history, your credit report may include errors that negatively impact your credit score. Assume you’ve paid off your debt in full and closed it on your end, but it’s still showing up as current due to a human error. Other issues and suspicious conduct should be on your mind as well. If you complete these tasks, your score will instantly increase. This is an important point on how to increase CIBIL score.

3. Maintain a well-balanced credit portfolio

A solid balance of unsecured loans, such as credit cards and personal loans, and secured loans, such as vehicle loans and home loans, is typically a good idea. Lenders prefer customers with a good number of secured loans, and credit bureaus reward them with a high credit score. Prepay your unsecured obligations to equalize your loan mix if you have a higher ratio of unsecured loans than secured loans.

4. You must keep the credit utilization in your mind

You must not use your credit card to all frequently in all transactions. A 30% ratio is fine for your credit card transactions. This point will make you know how to increase CIBIL score.

5. Don’t create a joint credit account with your significant other

Avoid becoming a joint account holder or a loan guarantor since any failure on the other party’s side might impact your CIBIL score.

6. Purchase a Protected Card

Your CIBIL score will improve if you get a secured card from a reputable Lending organization or others, and pay the amount on time. A comparable card is a Step-UP Card. This is an important point on how to increase CIBIL score.

7. Do not take on a large amount of debt at once

To avoid a drop in your credit score, it’s good to pay off your present loan before taking out another. If you take out many loans at once, you run the risk of not being able to return them all. Take out one loan at a time and pay it off entirely to improve your credit score.

Conclusion

Making money in today’s society is simply provided with one essential component: money. We’re in a scenario where we need money to earn money and waste a lot of time figuring out how to obtain it. Now that you know about how to improve CIBIL score, with lending organizations springing out in every town and city, getting money should be straightforward, but this isn’t always the case. Because lending entails risk, almost every financial institution uses a set of criteria to assess a borrower’s ability to repay a loan. We must keep track of your credit score since it is the most critical factor in determining whether you are qualified for a loan.