Between 2010 and 2022, the world has seen a major boom of startups everywhere. Developed and developing countries are empowering startups and small enterprises by helping them kick-start their business with various policies and support from the government side.

Financial support is also available both by the government and some private firms that help small businessmen to fund their startups and kickstart their businesses. When it comes to funding for startups, knowing where funds would be required and in what stages funding would be required is important.

To raise funds, a businessman or entrepreneur must be able to seek the right people and the right sources of funds.

Even though there are many different kinds of forums and support agencies in the world that can help startups to secure funds, it is important to know for oneself what are the available options and at what stage these options can be exploited to create a sound financial plan for the organization. It is important to have some sources of funding coming in every now and then when the startup is expanding at each level.

Types of Funding and the Various Stages of Funding

When it comes to fundraising for organizations or startups, knowing what are the stages where finding would be required, how much funds would be required at each stage and where these funds should be coming in from are the three important points to remember. For any businessman, fundraising for their company is the most challenging affair as this involves potential risk-taking for both the fund seeker and the fund provider.

When a startup is conceived by an entrepreneur, there is a capital amount that is invested by the owner(s) of the startup. This capital is usually from personal funding that is either own money or borrowed from friends and family. When a startup starts functioning, this capital becomes its equity.

Equity Financing is a good option to gather additional funding from more partners or investors. Based on the equity, investors may be able to pitch in more money for a stake in the company.

On the basis of equity, debt can also be taken from the various lending forums, which include banks, private lenders and government lending organizations. Fundraising for non profits is another type of fundraising where companies can approach organizations that help them gather funds from various sources.

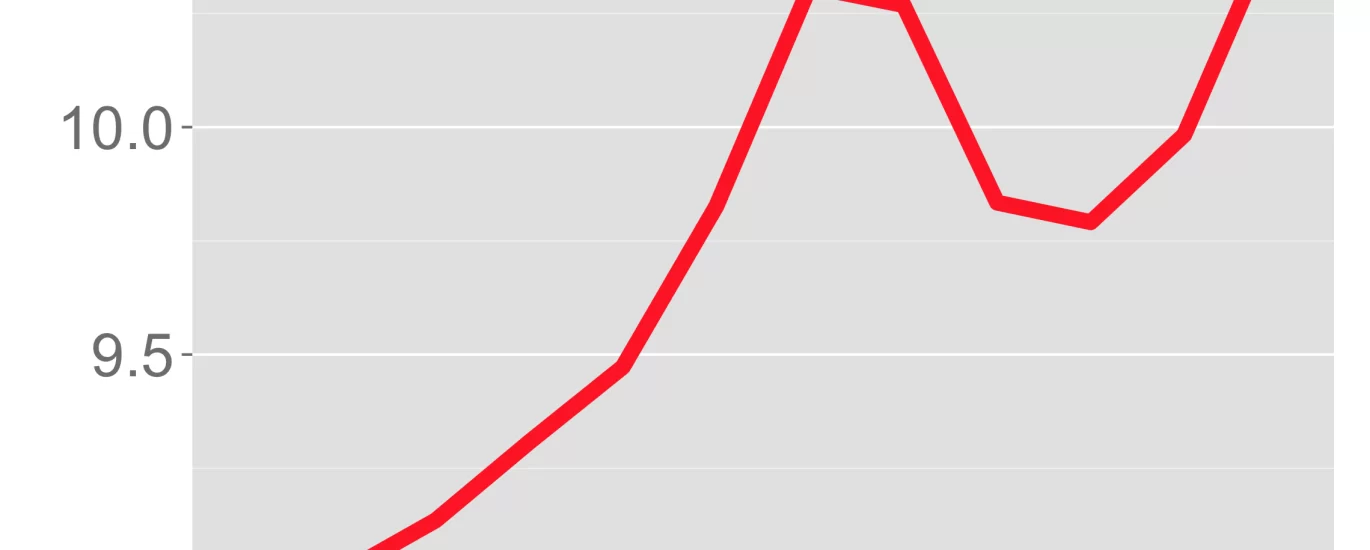

Many kinds of funding are present today, including the aforementioned options – Equity and Debt Financing. Each type of option that is used to raise funds is to be done in a carefully planned manner so that at each level of the startup progress, growth and expansion, there is some means of investment or funding that is coming in. Below are the types of funding that are most popular and the stages at which these options must be considered:

Borrowing from friends and family

This kind of financing is usually done at the conception level.

Bank Loans

Bank loans are primary sources to gain capital at the seed level and can also be used for expansion in stages B, C, etc.

Angel Investors

Angel Investors can be approached for funding between the seed level and Stage A expansion level.

Venture Capitalists

VC forums can help in securing funds post the seed phase when the company can show its growth, mainly for further funding for expansion.